*This is the first in a series of posts that will debunk common investment myths. I will conclude the series by describing an investment strategy that I believe gives investors the best chance to reach their goals – one based on investment realities, rather than myths.

Investing vs Gambling

Years ago, a friend of mine told me he had been taught that investing in the stock market was no different than gambling. As someone who is strongly in favor of investing and strongly opposed to gambling, this statement caught me off guard.

However, as I thought about it, I could see why someone might make that comparison. If you watch the price movements of the stock market day-to-day, they appear to fluctuate up and down in a random motion. We’ve all heard stories about someone who got in just at the right time on a tech stock and made millions, much like someone winning the lottery. Or on the flip side, you may know someone who lost a fortune on a series of bad trades. It all just seems like pure luck.

The truth is, while some people treat the stock market like a casino (more on this in Part 2), true investing is not gambling at all. Done right, investing in the stock market can be one of the best ways to build wealth over time. To see the difference between gambling and investing, it’s important to understand what a zero-sum game is and how capital markets work.

Zero Sum Game

A zero-sum game is a situation in which someone has to lose for someone else to win. For example, imagine you discover donuts in the break room one day at work. Each donut you decide to eat is one donut a co-worker doesn’t get to eat. Your gain is your co-worker’s loss.

Gambling is clearly a zero-sum game. If five friends get together to play poker and each brings $100, only $500 is leaving the table at the end of the night. Someone will inevitably go home with more $100, but each dollar gained by one player is offset by a dollar lost by another.

In zero-sum games, there is no creation of wealth, only transfers of wealth between participants.

Capital Markets

Unlike gambling, markets actually do create wealth. To see why this is true it’s easier to focus on an individual company, rather than this abstract thing we call “the market”. When a company issues stock, they aren’t handing out lottery tickets, they are offering ownership in their company. The investment is used to purchase new buildings or equipment, hire workers, etc. all with the goal of generating profits. As an owner in the company, you are entitled to a portion of those profits.

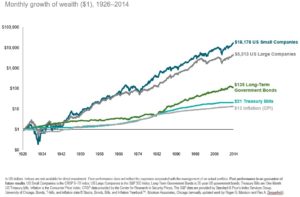

Of course, there is a risk in investing. Individual companies can go bankrupt. During times of economic uncertainty, the entire stock market can fall dramatically. However, unlike gambling, investing has rewarded disciplined, long-term investors throughout history, averaging about 12% per year for small company stocks and 10% per year for large company stocks.

The key is to make sure you invest in a way that keeps the odds in your favor.

To schedule a complimentary, no-obligation introduction click here.