How We Invest

We believe the primary goal in investing should to harness the power of financial markets – not try to outguess them. While most of the industry sells stock-picking and market-timing prowess, the research shows that investors almost never benefit from this approach.

We utilize an evidence-based approach to investing that focuses on diversification and discipline, and minimizes expenses and taxes. This approach minimizes risk and allows our clients to capture their share of the returns the market generates. Most importantly, it gives them the best chance at reaching their financial goals.

The Traditional Approach, aka the Wizard of Oz Approach

While the evidence clearly shows that trying to “beat” the market is a losing game, most investment advisors focus their entire marketing and retention efforts on trying to convince customers that they have a secret formula, magic bullet, or crystal ball. Often, the result is increased complexity and turnover so the advisor can appear to be doing sophisticated things behind a curtain of mystery. Meanwhile, clients pay the price in the form of increased fees, transactions costs, and taxes. As Steve Forbes put it, “You make more money selling advice than following it.” So while the majority of the financial industry will continue to do what they get paid to do – sell products, gather assets, etc. – we believe there is a better way.

An Alternate Approach

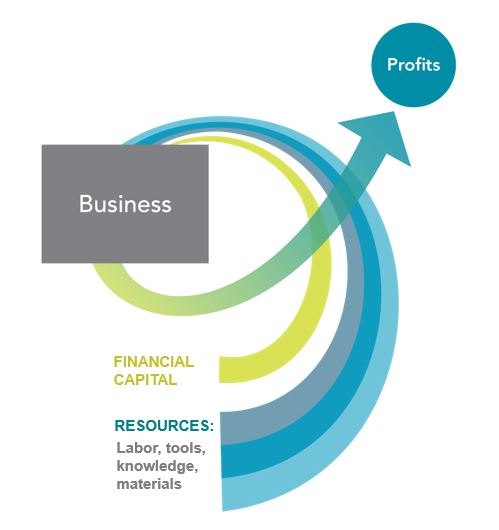

Fortunately, there is another approach that is supported by decades of academic research. The key to this approach is understanding how capital markets work. Investing is not a zero-sum game where one investor must lose so another can win. Over the long run, markets reward investors for taking risk and providing capital.

In addition, the price mechanism of markets allows for the rapid processing of new information. At any given time, current prices reflect the knowledge and expectations of all investors. Although prices are not always “correct”, markets are so competitive that it is unlikely any single investor can routinely profit at the expense of all other investors. In other words, there is no free lunch—the only way to expect to earn higher returns is to take more risk.

Our Focus

With this foundation, we can turn our attention from the losing game of trying to outguess the market, and instead focus on the things we can truly control. We start by understanding the needs, goals, risk tolerance, and attitudes of each client. We then diversify broadly across a range of assets classes with an emphasis on minimizing expenses and taxes. Lastly, we work with our clients on a continual basis to provide perspective and discipline. We believe this approach helps our clients keep their share of market returns and gives them the best chance of reaching their goals.

Partner with us for a transparent, no-gimmick experience.

Access to Dimensional Funds (DFA)

Dimensional Fund Advisors (DFA) is one of the primary mutual fund companies we utilize in client accounts. DFA funds are built using the same academic research we rely on to develop our investment philosophy, and as such, they make a perfect partner.

If you aren’t familiar with DFA, here are five reasons you should get to know them (see our blog post for more details):

- Their strategies are developed using academic research

- They have a thoughtful implementation process that adds value to investors

- Their funds have some of the lowest expenses in the industry

- They only work with advisors who understand the research and have a disciplined approach

- Their funds have a long track record of outperforming