Why Index Funds and Flat Advisory Fees Go Together

Percentage fees (known in the industry as assets under management or AUM fees) have no place in the future of financial advice. They are a relic of the past – when the job of financial advisors was to actively trade your portfolio, trying to pick the next hot stock and time the market.

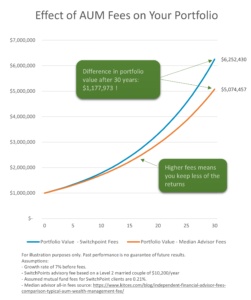

While the concept of passive, evidence-based investing using index funds has become widely accepted, advisors still manage to charge the same % fee that they have for decades. These fees can drastically reduce the performance benefit of index funds and DFA funds.

The truth is, the services provided by true professional advisors don’t vary by account size. So, a fee based on a percentage of your portfolio makes no sense. Furthermore, AUM fees introduce significant conflicts of interest and lead to unconscionable profit margins on large portfolios.

Today, the role of a financial advisor is to provide education and discipline – not to day trade your accounts. It’s to provide an objective perspective on your entire financial picture and help you design and implement a plan to meet your goals.

A flat fee compensates your advisor for the services provided, rather than arbitrarily tying the fee to your account size. Most importantly it removes conflicts of interest inherent in other compensation models and it allows you to capture the returns that the market generates.