Our Fee Structure

We have built an annual flat fee structure that compensates us for our expertise and the services that we provide, rather than a client’s portfolio size. We firmly believe that a flat annual fee is a more appropriate compensation method for wealth management than the traditional percentage of assets under management.

A primary principle in economics is that people (including advisors) respond to incentives. We believe that our fee structure puts us on the same side of the table as our clients. Having the right incentives, combined with our expertise and experience, allows us to give the best advice possible to our clients.

Conflicts of Interest

Many financial advisory firms claim that their interests are aligned with their clients’ when they charge a % of the assets they manage. They want the account to perform well and to avoid losses, just like the client. This sounds good, but is far from the truth.

First, most clients’ goals are not to increase the assets held by their financial advisor. Certainly, they want to see a positive return on their investments, but their actual goals have much more to do with things like enjoying retirement, feeling secure and leaving a legacy.

Why does this distinction matter? Think about the following scenarios and the conflicts that could arise due to your advisor’s sole incentive of increasing the assets he manages:

- Paying off debt – Many of my clients have a goal to become debt free. While there can be pros and cons to using investment assets to pay off debt, deciding if it is the right move for you should only involve the effects on you, both financially and emotionally. However, advisors who charge AUM fees have a conflict with a client who wants to remove assets to pay off debt. They will likely be providing nearly identical services after the withdrawal, but their fees will be reduced.

- Annuities – here’s a riddle: Most advisors will tell you that compensation structure is irrelevant, you just do what’s right for the client. Perhaps those advisors can explain to me why commissioned-based advisors recommend annuities to everyone, but AUM based advisors never recommend them. To me the answer is obvious, commissioned based advisors make huge commissions by selling annuities, while AUM based advisors give up their client’s assets (and therefore their ability to charge AUM fees) when they recommend annuities.

- Gifting – similar to the debt reduction scenario, many clients have gifting goals, and would like to see their money at work, rather than wait to gift when they pass away. That gifting may bring a client great satisfaction, but will bring an AUM based advisor a hit to his bottom line.

- Spending – many of my newly retired clients are healthy and anxious to travel and enjoy their new-found freedom. Many advisors use client’s fear of running out of money to get them to live on unreasonably low budgets. An advisor who charges on your assets would love for you to have millions left in your portfolio when you pass away. For most of my clients, they’d much rather enjoy that money in retirement.

Economies of Scale

Under an AUM based approach, an investor with $5,000,000 will pay about 10x what an investor with $500,000 pays, even though the services offered are essentially the same.

Of course, investors with larger account balances sometimes have need of additional services. However, I can tell you based on my experience with hundreds of clients over the years, there is often very little correlation between the work done and the size of your account.

As a result, if you have a large account balance, you provide your advisor with an unconscionable profit margin.

You should be the one who benefits from the economies of scale your large account balance provides, not your advisor.

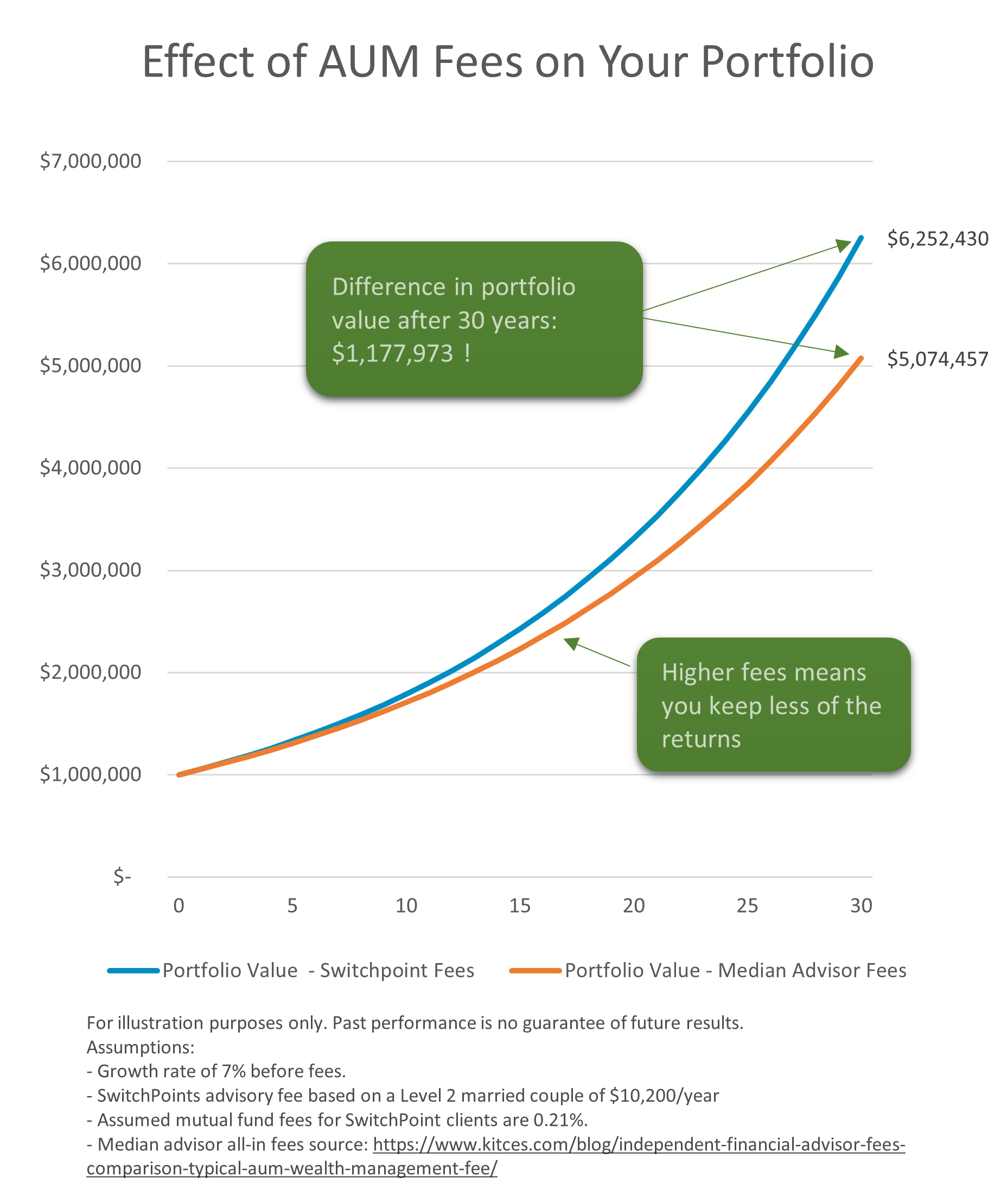

The difference between a typical advisory fee and a flat annual retainer fee over a long period of time can be overwhelming.