As a financial advisor, I am often asked: “Where should I put my money right now?” The financial industry has trained us to treat our investment plan like we treat our fantasy football team – requiring constant tweaking based on predictions of who has the “hot hand.” The reality is, the keys to successful investing don’t change from day to day based on what some guru says is going to happen in the market.

Here are my six keys to success:

1. First things first

So your co-worker keeps bragging about how much they made on Google stock or maybe your parents keep telling you they wish they started investing earlier, and you’ve decided you need to start investing in the stock market.

Not so fast.

One of the quickest ways to spoil a well laid investment plan is to start investing before you are financially ready. Before you start investing, in the long run, you need to ask yourself these questions:

- Do I have any consumer debt?

- Do I have a sufficient emergency fund?

- Do I have any significant upcoming expenses, such as a baby, a new car, or college tuition?

- Do I own my home?

These issues aren’t all necessarily deal-breakers, but they are important considerations. The bottom line is you want to have a solid foundation in place before you start investing so that you aren’t forced to tap your investment accounts at an inopportune time.

2. Know thyself

Investing can be an emotional roller-coaster at times. One of the saddest things I’ve witnessed as a financial advisor is an investor who tells me they sold everything right at the bottom of a market crash. As humans, our fight or flight response kicks in when things get scary. For much of history, this reaction has served us well. In investing, it’s one of the biggest threats to success.

In my practice, I spend a lot of time helping clients understand the realities of investing in the stock market and discussing appropriate reactions to a market pull-back. Sometimes, the key to long-term success is to dial back the risk to a comfortable level so that you can stay the course long enough to take advantage of the good markets.

Want to learn more about your appetite for risk? Find out by taking this quick questionnaire.

3. Match your risk to your time horizon

Once you understand your personal risk preferences, you need to align your investment strategy with your goals. In general, the sooner you will need the money, the less risk you should take.

For example, if you are 20 years from retirement, you likely can afford to take more risk with your retirement accounts than someone who is already retired.

On the flip side, you wouldn’t want to take a lot of risk with money that you plan to use for down payment on a house in two years.

4. Diversify, diversify, diversify

“Don’t put all your eggs in one basket” is a phrase we’ve all heard a hundred times. But it really is great advice. Diversifying doesn’t eliminate risk or guarantee a positive result. After all, you are still bound to spill your basket of eggs occasionally. The point of diversification is that it spreads the risk out. When something bad does happen, it’s not as devastating.

Of course, you have probably heard stories about someone who bought Apple when it was selling for a few dollars per share and made millions. But I can assure you that as a professional advisor who has seen hundreds of investors’ portfolios, I have seen far more cases of concentrated positions causing a lot of pain, sometimes devastation.

5. Mind the fees (and not just the stated ones)

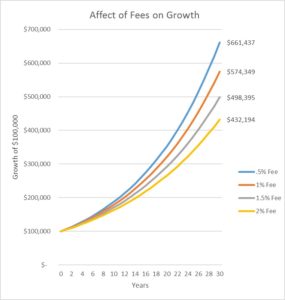

The investment industry does its best to hide its fees from plain sight. They also like to state their fee as a percent, rather than a dollar amount. After all, 1-2% seems like such a trivial amount. However, paying an extra 1% per year in fees can add up to hundreds of thousands of dollars over the long run.

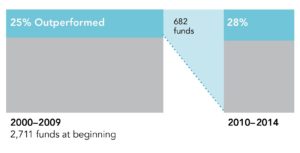

Still, it can be tempting to pay more for a mutual fund or investment manager who claims to have a secret sauce that will allow him to “beat the market.” Unfortunately, research shows that your chances of selecting such a manager are very low. Few managers beat the market over the long haul. Even the ones that have managed to do so in the past rarely persist as winners.

Do Outperforming US Equity Mutual Funds persist?

Paying for something that you are unlikely to actually get is, in my opinion, not a good use of your hard-earned money.

6. Ignore the noise

Once you have implemented a plan that makes sense for your situation, do yourself a favor and tune out the media. The media has one goal and one goal alone, to sell ad space.

Steve Forbes once admitted:

“You make more money selling advice than following it. It’s one of the things we count on in the magazine business — along with the short memory of our readers.”

Investing is like growing a garden – it takes careful planning, consistent care and time to grow. You would never plant a garden and then tear it up a week later because the weather man said it might rain or constantly replace plants all summer, hoping for a seed that will grow faster than the one before it. Before you know it, the summer will be over and you’ll have little to show for it.

Likewise, investing requires a good dose of discipline and patience.

To schedule a complimentary, no-obligation introduction click here.