The investment industry has done a phenomenal job of masking their fees – whether hiding them completely or trying to minimize them by stating them as a % of assets. Today, we are going to look at the reality of how much Wall Street is siphoning from your accounts every year and how it could affect you in the long-run. (Spoiler alert: It could be in the hundreds of thousands or millions of dollars)

Let Me Count the Ways

Most investors realize they are paying something to invest. If you have an online brokerage account, you are probably familiar with the brokerage commission you are charged for trading. If you own mutual funds you likely recognize that there is a fee paid to manage the fund. What most people don’t realize is how many ways Wall Street is actually getting at their money. Here is a list of the common expenses:

- Advisory fees – Advisors make money in one of two ways (or sometimes both!):

- Commissions – Mutual funds sold through a commissioned-based advisor commonly charge a 5% upfront “load” followed by 0.25% per year thereafter, known as a 12b-1 fee. This is on top of the underlying mutual fund expenses, which we’ll get to later.

- Asset-based fees – many advisors who work with clients who have significant assets charge a fee based on the assets they manage. This fee is typically around 1%1, but often starts higher for small account balances, and gradually decreases for larger accounts.

- Fund Fees – Rather than owning individual stocks, owning mutual funds or ETF’s can be a smart way for investors to get proper diversification and professional management. Of course, there is a fee involved in the management of these funds. According to a 2015 Morningstar study2, the average mutual fund fee is about 0.64%.

- Transactions costs – There are three different types of transactions costs which together have been estimated to cost investors about 0.50% annually3:

- Tangible brokerage costs – these are fees paid to the broker when a mutual fund buys or sells stocks. If you did deep enough, you can find them on the fund’s “Statement of Additional Information”.

- Bid-ask spread – this is not an explicit fee, but rather a cost of trading in the market. Markets are made up of a series of buy and sell orders – investors who would be willing to buy or sell at a specified price. If you are looking to trade right now, you have to “cross” the bid-ask spread and take the price that a patient investor is offering.

- Price impact – Sometimes urgent buyers or sellers can actually move the market price if the number of shares they want to buy exceeds the number available at the best price. These are investment costs that are never really seen, but they can have a significant effect on investor returns.

Small Fees, Huge Effects

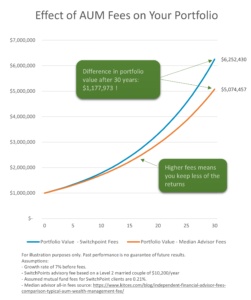

Again, part of the reason the investment industry has been able to get away with charging such high fees for so long is that the fees seem small – one percent here, a half a percent there. What’s the difference? Well, frankly, the difference is staggering. I decided to compare the average industry fees with the fees charged at SwitchPoint. Here’s what it looks like:

In other words, those “small” fees ate up $1M of your money over 30 years!

Paying for True Value

My point in all of this is not to say that all fees are bad. Paying higher fees for higher value is a perfectly reasonable trade-off for some people. After all, there are those who choose the luxury car because it has features they value, like leather seats or a more powerful engine, even though the economy car can get them where they need to go. However, in the financial world, determining whether you are getting the higher value you are paying for is often a difficult proposition for two reasons:

- So many fees are hidden from view.

- There is often no clear-cut way to measure the benefits you are receiving and many times those benefits aren’t apparent until years later.

The difference between our fees and average industry fees can be largely attributed to two activities that I have written on many times previously. Research has shown that spending money on these activities has a very low chance of paying off. They are:

- Trying to pick stocks or time markets (as discussed here)

- Trying to select managers or strategies that have a special ability to pick stocks or time markets (as discussed here).

By cutting these two activities, we are able to save our clients a lot of money and instead spend our efforts on services that truly add value, like:

- Helping you gain clarity on your goals and plans

- Designing a financial plan that aligns your resources with those goals

- Providing discipline and accountability

- Minimizing taxes

These are the services we focus on at SwitchPoint. No gimmicks. No empty promises. Just professional advice that makes a real difference in our clients’ lives. If you are interested in a straightforward approach that focuses on you and your needs, I’d love to meet with you and see how we can help.

You can schedule a complimentary, no-obligation introduction. Just click here.

Sources

1http://www.advisoryhq.com/articles/financial-advisor-fees-wealth-managers-planners-and-fee-only-advisors/ 2https://news.morningstar.com/pdfs/2015_fee_study.pdf 3http://johncbogle.com/wordpress/wp-content/uploads/2010/04/FAJ-All-In-Investment-Expenses-Jan-Feb-2014.pdf