I just finished a new book by Michael Lewis, author of many bestsellers including The Blind Side and Moneyball. His new book, called The Undoing Project, is about the fathers of a relatively new field of study called behavioral economics. It tells the story of two Jewish academics, Danny Kahnemann – a holocaust survivor – and Amos Tversky – a native Israeli and decorated soldier – who changed how the world thinks about decision making.

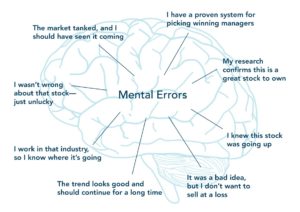

Prior to Kahnemann and Tversky’s work, the field of economics – and by extension finance – viewed people as inherently rational beings. However, Kahnemann and Tversky showed not only that people aren’t always rational, but that there were consistencies in the way people made errors. These biases weren’t random, but persistent. Here are a few examples:

Hindsight bias – this is the tendency to view past events as predictable. As Amos puts it, “we find ourselves unable to predict what will happen; yet after the fact we explain what did happen with a great deal of confidence” (Lewis 207).

Hindsight bias – this is the tendency to view past events as predictable. As Amos puts it, “we find ourselves unable to predict what will happen; yet after the fact we explain what did happen with a great deal of confidence” (Lewis 207).

In finance, this becomes particularly common after big market meltdowns. Experts and pundits always seem to have a neat story for why everything happened. The danger in this bias is that it leads us to believe that the world is more predictable than it really is.

Availability bias – this bias leads us to make judgments based on what is easiest to recall – what is most available to our memory. For example, we are likely to believe our chances of contracting a rare disease are higher if we have recently learned that our neighbor has it.

In investing, this is often seen when people sell after a big market crash, believing that prices are likely to keep falling. Or on the flip side, they buy into the market after a sustained rise in prices, believing that prices will keep rising.

The Behavior Gap

So why does any of this matter? It matters because these mental errors that are a part of our human DNA make us terrible investors. Our intuition leads us to:

So why does any of this matter? It matters because these mental errors that are a part of our human DNA make us terrible investors. Our intuition leads us to:

- buy when markets are high and sell when markets are low.

- hold onto losing investments too long because we don’t want to realize the loss that has already happened on paper.

- chase performance, believing that a hot stock or mutual fund will keep winning

- and many other things that are bad for our financial health

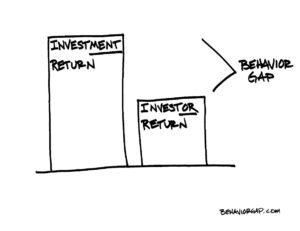

These errors cause investors to under-perform the market by a considerable margin. Carl Richards, an author, artist and financial advisor, dubbed this difference between market returns and investor returns the “Behavior Gap.”

The Size of the Problem

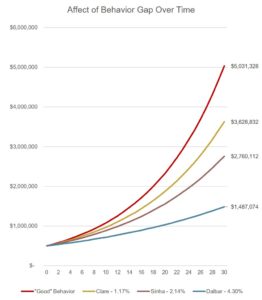

Many studies have attempted to quantify the behavior gap. One of the most commonly cited studies, by a firm called DALBAR, estimates the gap at 4.3% per year. Some of the other studies have lower estimates, but most are at least at or near 2%. Here’s what that looks like over 30 years, assuming a starting account value of $500,000 and an 8% annual return.

If the folks at DALBAR are right, then the difference over 30 years is $3.5 million. Ouch! Even using the smallest estimate I found of 1.17%, the ending value is reduced by $1.4 million. We’re talking big numbers here.

The Remedy

As a financial advisor, one of my primary goals is to help my clients avoid this behavior gap and reap the returns that markets generate. There are 3 keys to accomplishing this:

- Knowledge – First, investors need to understand the realities of investing in different markets. Many advisors like to take the approach of “Just give us your money and we’ll make sure nothing bad happens.” This is a recipe for disaster. Something bad inevitably happens. Markets go up and down. And then the investor feels disillusioned and pulls their money out, at exactly the wrong time. One of my most important jobs is to help investors understand the risks they are taking and how their investments will react in different market environments.

- Planning – Creating a long-term plan, or Investment Policy Statement gives investors a roadmap – guidelines that will help them successfully navigate toward their stated goals. Without a plan, it’s far too easy to be tossed by the winds of the market in no specific direction.

- Accountability – The reality is, we are all emotional when it comes to our money. Having an objective voice of reason during times of stress or uncertainty can be an invaluable resource. As an advisor, I help people remember their plan and realize that the success of their plan does not depend on avoiding every temporary decrease in the market. The success of their plan depends on them remaining disciplined so they can capture market returns.

I believe that with increased knowledge, a well-designed plan, and ongoing accountability, investors can avoid the behavior gap and greatly improve their odds of reaching their goals.

To learn more, you can schedule a complimentary, no-obligation introduction. Just click here.

Sources:

Lewis, Michael. The Undoing Project. New York: W.W. Norton & Company, 2017. Print.

Dalbar – DALBAR Quantitative Analysis of Investor Behavior, 2012

Clare – Clare & Motson. Do UK retail investors buy at the top and sell at the bottom. 2010.

Sinha – Sinha & Jog. Fund Flows and Performance. 2005