Would you like to know how winners of the Nobel Prize in Economics invest? Look no further than Dimensional Fund Advisors (DFA). DFA has been implementing the great ideas in academic finance since it was founded in 1981. Nobel Laureates Eugene Fama and Myron Scholes sit on the firm’s Board of Directors, as well as several other notable academics.

By harnessing the greatest minds in the field and following a disciplined and rigorous implementation process, DFA has built an impressive track record of outperforming both benchmarks and peers. Dimensional now manages more than $600 Billion, making it one of the largest (and fastest growing) mutual fund companies in the country.

And yet, they are still unknown to some investors. Why?

- Only available through select advisors. DFA funds are not available to the general public in retail investment accounts. Instead, they are sold only through select financial advisors who have gone through a lengthy approval process.

- No Revenue Sharing. In order to keep the cost of their funds as low as possible, DFA doesn’t pay commissions or kickbacks to the advisors who recommend their funds. Lower costs mean higher returns for investors, but a lack of commissions acts as a deterrent to commission-based advisors.

- No Advertising. Because DFA only sells its funds through a select group of advisors, they have no need to advertise to the public. You won’t see commercials, magazine ads, or radio spots from DFA. Instead, they grow by attracting advisors who embrace their investment philosophy.

If you aren’t familiar with DFA, here are five reasons you should get to know them:

- Their strategies are developed using academic research

- They have a thoughtful implementation process that adds value to investors

- Their fund have some of the lowest expenses in the industry

- They only work with advisors who understand the research and have a disciplined approach

- Their funds have a long track record of outperforming

1. DFA’s Academic Approach

“People at Dimensional care much more about getting the right answer than defending their answer.”

KENNETH FRENCH – Professor, Dartmouth College. Dimensional Director, Consultant, and Co-Chair of the Investment Research Committee

Dimensional’s approach to investing is based on decades of academic research. This dedication to research creates a culture of seeking for truth and basing strategies on scientific evidence.

I can tell you in my years of working in this industry, this is a unique approach. Many fund companies take the opposite approach – letting the marketability of a strategy inform the investment decision.

What does the academic literature tell us about investing?

A. Markets Work

Capital-based economies thrive because markets work. The market is an effective information-processing machine and incorporates all available information on a company and its future prospects into securities prices. Intense competition drives stock and bond prices to “fair” value. This concept, known as modern portfolio theory, revolutionized the field of finance, and earned Eugene Fama a Nobel Prize.

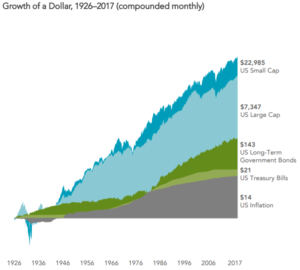

Fortunately, throughout history, markets have rewarded disciplined investors for providing capital.

B. Risk Factors Drive Returns

Investors demand compensation for taking risk. As such, risk and reward are related – higher risk assets have higher expected returns. The return of a portfolio is largely driven by its exposure to various risk factors – or “dimensions” of return. The primary drivers of returns in the stock and bond markets are:

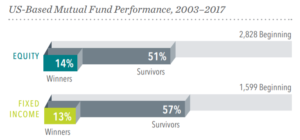

C. Stock Picking & Market Timing Have Low Odds of Success

Back in 1965, Michael Jensen did the first study of mutual fund manager performance. His research indicated that the vast majority of highly skilled and talented managers fail to beat their benchmarks. In fact, the number of managers who did outperform the benchmarks was no different then we would expect by simple random chance. Many studies have been performed since, with similar results. Over time, managers who attempt to pick stocks just can’t consistently pick them well enough to overcome the associated costs.

![]()

2. DFA’s Implementation Process

“It’s 10% having a good idea and 90% implementing that idea and making it work. Dimensional has been making it work for decades.”

ROBERT MERTON – Nobel laureate, 1997. Professor, MIT. Dimensional Resident Scientist.

Dimensional combines it’s deep knowledge of how markets work with a disciplined process that puts the odds in your favor.

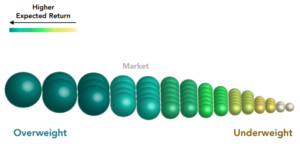

Portfolio Design

Dimensional’s portfolios are designed to capture the risk factors that drive returns. For example, since the research shows that small company stocks outperform large company stocks, DFA’s portfolios will overweight the small stocks in order to capture this return premium.

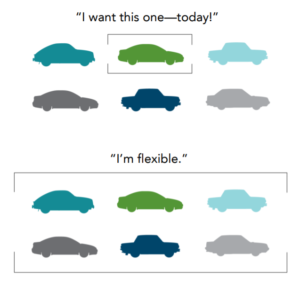

Patient Trading

Most mutual fund managers are compelled to pay a premium when they trade due to the urgency of their investment decisions. However, DFA is different. They maintain flexibility in their trading, which reduces costs and improves returns.

Tax-efficiency

DFA funds are very tax efficient. Mutual funds incur taxes in the same way individual investors do – by selling stocks at a gain. The IRS requires mutual funds to pay out those capital gains on an annual basis, hitting investors with a tax bill. The way DFA minimizes these taxes is by avoiding selling. In other words, they buy and hold for the long run. These tax savings can add up significantly over time.

3. DFA’s Low Costs

“The grim irony of investing is that we investors as a group not only don’t get what we pay for, we get precisely what we don’t pay for.”

JOHN C. BOGLE – Founder, The Vanguard Group

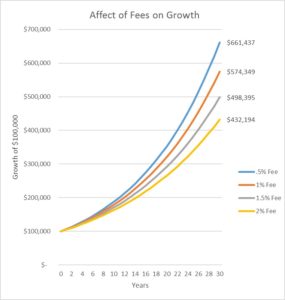

In investing, costs matter. Just a 1% difference in fees can add up to 100’s of thousands of dollars over your lifetime.

As discussed earlier, most stock pickers fail to outperform their benchmarks. Why pay a high price for something you have very low odds of actually getting?

Nearly all of DFA’s mutual funds’ fees are in the lowest 10% of funds in their respective categories. And many are in the lowest 2-3%.

4. DFA’s Advisor Approval Process

“The important thing about an investment philosophy is that you have one you can stick with.”

DAVID BOOTH – Founder and Executive Chairman of Dimensional Fund Advisors

Dimensional’s approach to investing and their distribution strategy go hand in hand. As I mentioned earlier, DFA funds are not available to retail investors.

Why?

- Investor experience – Investing is an emotional experience. Markets are volatile and it can be difficult to maintain discipline when your investment strategy doesn’t seem to be working. There have been a number of studies done that show that investors’ returns tend to be significantly lower than the return of the funds they invest in. This happens because investors chase performance (they buy funds that have recently done well) and they flee danger (selling funds that have recently done poorly). While this instinct has served us well in some areas of life, it is a recipe for disaster in investing. Having an advisor who has a deep understanding of investing and who follows a disciplined approach can help investors capture the returns that markets generate.

- Protect existing shareholders – finicky investors who are constantly buying and selling create a problem for existing investors. When investors add or take away money, portfolio managers have to put that money to work, buying and selling stocks. This increases costs for existing shareholders. It also can create tax problems if managers have to sell stocks with capital gains. For this reason, DFA prefers to have disciplined, buy and hold investors invest in their funds. By utilizing advisors who share their long-term perspective, they are able to protect their current shareholders and keep costs low.

This advisor approval process isn’t just a charade. DFA’s philosophy has served them and their investors well. For example, in 2008, when most mutual fund companies saw huge outflows – investors selling and running for the hills – DFA investors actually stayed disciplined and continued investing during this time.

5. DFA’s Track Record

“Our long-term results match the long‑term research.”1

DAVID BOOTH – Founder and Executive Chairman of Dimensional Fund Advisors. Dimensional Fund Advisors, 35 Quotations on a Better Way to Invest (July 2016).

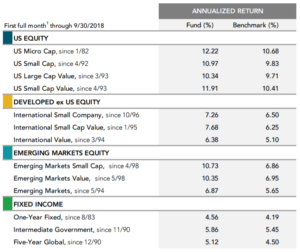

DFA’s performance speaks for itself. Across time, markets and regions, Dimensional’s investment strategies have delivered outstanding performance relative to their respective benchmarks (see below) and peers.

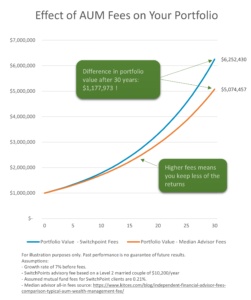

Advisor AUM Fees Can Destroy DFA’s Performance Advantage

Because DFA funds aren’t available in retail accounts, in order to access them you’ll have to hire an approved advisor. Unfortunately, financial advisor fees – usually around 1% of your portfolio – can erode the performance advantage of DFA funds.

In my opinion, these percentage fees (known in the industry as assets under management or AUM fees) have no place in the future of financial advice. They are a relic of the past – when the job of financial advisors was to actively trade your portfolio, trying to pick the next hot stock and time the market.

While the concept of passive, evidence-based investing has become widely accepted, advisors still manage to charge the same % fee that they have for decades.

Access DFA Funds Using a Flat Fee Financial Advisor

The truth is, the services provided by true professional advisors don’t vary by account size. So, a fee based on a percentage of your portfolio makes no sense. Furthermore, AUM fees introduce significant conflicts of interest and lead to unconscionable profit margins on large portfolios.

No more.

Today, the role of a financial advisor is to provide education and discipline – not to day trade your accounts. It’s to provide an objective perspective on your entire financial picture and help you design and implement a plan to meet your goals.

Along with this new definition of financial advisor comes a new compensation method – flat fee.

A flat fee compensates your advisor for the services provided, rather than arbitrarily tying the fee to your account size. Most importantly it removes conflicts of interest inherent in other compensation models and it allows you to capture the returns that the market generates.

SwitchPoint and DFA

As a fee-only fiduciary, SwitchPoint’s only loyalty is to its clients. We have no sales relationship or duty to Dimensional Fund Advisors. We have used and will continue to use other mutual funds where we believe they have an advantage over a comparable DFA fund or in a category where DFA doesn’t currently operate.

However, we are an approved advisor with DFA and we do utilize their funds in our clients’ (as well as our own) portfolios. We choose to construct portfolios using primarily DFA funds for all the reasons described above. We believe that their funds offer our clients the best combination of a robust, research-based investment strategy, cost-effectiveness, tax efficiency, trading acumen and consistency of strategy implementation.

Finally, we believe Dimensional offers us and our clients peace of mind. Having an investment philosophy that is fully transparent and backed by decades of research helps us sleep at night. We don’t have to wonder about a star manager losing his touch or a new fad idea not panning out.

Instead, we can focus on activities that truly add value to our clients’ lives, like retirement planning and tax planning. We can spend more time understanding our clients needs and goals and then liberate them to enjoy the life that they desire.

If this approach to investing appeals to you and you’d like to learn more about our services and our flat fee, click here.

You can also schedule a complimentary, no-obligation introduction here.