While retirement is often depicted as relaxing and carefree, the reality is that the financial uncertainty of leaving behind a steady salary can lead to high levels of anxiety. Helping relieve this anxiety is one of the most satisfying parts of being a financial advisor.

Often, I see investors hyper-focus on the one thing over which they have the least control: the performance of the stock market. Of course, believing that your retirement success depends solely on something you can’t control leads to anxiety!

Unfortunately, this hyper-focus takes people’s attention away from the things they actually can control. And it leads them to make mistakes that could cost them $10,000’s or even $100,000’s.

If you are approaching retirement, now is the time to get your ducks in a row. If you’d like to reduce your anxiety and maximize your chance for success in retirement, here are 5 common mistakes to avoid:

1. Failure to Plan

The first mistake I see so many people make is that they don’t have any retirement plan at all. Maybe they heard on TV that the average person needs $1,000,000 to retire, so they plan to work until they reach that number. Maybe they’ve gone a little deeper and filled out a calculator online. But a lack of a detailed and specific financial plan can result in missed opportunities.

a. Do you have enough to retire?

A fundamental part of your retirement plan is figuring out how much you need to retire. This number will be different for everyone, depending on spending habits, longevity expectations and tax treatment of investment assets.

Using online calculators or rules of thumb will likely lead to sub-optimal outcomes. I’ve seen many people retire too early and then face the reality of going back to work or drastically cutting spending. I’ve also seen the opposite – people who kept working long after they needed to.

Having a plan in place will allow you retire with confidence and enjoy what you have without worrying about running out of money.

b. When and how to take social security and pensions

Another big mistake I see people make is not properly planning for guaranteed income sources like social security and pensions.

I’ve been amazed at the number of people I meet with who look at me in amazement when I tell them that their stay-at-home spouse will be entitled to ½ of the working spouses social security benefit. This can be worth upwards of $1,500 a month in some cases!

Of course, there’s also the question of when to take social security. Do you take it early? Wait until 70? There are many things to consider:

- What’s your expected longevity? If you expect to live into your 80’s or 90’s, you’re likely better off waiting as long as possible to take Social Security

- Do you have a spouse with benefits?

- What other means do you have to subsidize income if you delay filing for social security?

- Do you value having higher guaranteed income or a larger portfolio balance?

Many pension plans offer various options for withdrawal, including surviving spousal benefits and lump sum payouts. Making a decision to take the lump sum payout should be weighed carefully. Typically, calculating an effective rate of return on the payout is a good first step. This can be done in excel using the RATE function or with a financial calculator. If your pension has a low effective return, you may want to strongly consider taking the lump sum payout.

If you do take a lump sum and it’s a large amount, make sure to roll it to an IRA. Otherwise, the entire distribution will be taxable in the year you take it, likely pushing you into a high tax bracket.

c. Minimizing taxes

The other place where you can give up $1,000’s when you fail to plan is in your taxes.

For example, when you have a detailed plan in place, you can estimate your taxable income each year of retirement and take advantage of strategies like Roth conversions. A Roth conversion is done by converting money in an IRA or 401k to a Roth IRA. The idea behind this is that you are moving money from a bucket that will be taxable when you make withdrawals (your IRA), to a bucket that has tax free withdrawals (your Roth). It can make sense to do this in years when you have low income and are in a low tax bracket.

Another strategy is called asset location, which I describe in detail here. This strategy is all about putting the right investments in the right types of accounts in order to maximize after-tax returns.

If you’ve managed to save a sizable nest egg, the government can’t wait to take it’s share. Careful tax planning can keep more money in your pocket and allow you to live a more comfortable retirement.

2. Lack of Diversification

The second mistake I see people make is failing to diversify properly. I have seen this devastate many retirement plans. A concentrate portfolio, where you put too many of your eggs into one basket, can literally destroy your entire portfolio. I’m going to describe three different levels of concentration in order of risk, starting with the riskiest:

a. Private investment, startup, or hedge fund

Have you ever been approached by a family member, friend, business associate, member of your church congregation, or other acquaintance for an investment? Maybe they had a great idea for a new product or service. Or perhaps they had a secret algorithm or strategy for investing that had great promise.

The first thing I would say is, proceed with caution.

The odds of success for new startups is extremely low, even the ones that seem like a sure thing. Whether it’s your best friend, neighbor, or maybe you have an idea of your own, you should think twice about mortgaging your retirement to start a business.

The hedge fund that promises to never lose money is almost certainly either lying or so naive that you’d never want to invest your money there. If you are considering an investment like this, ask if your accounts will be “co-mingled”. This means your money is mixed with all the other investors’ money – a prime breeding ground for a Ponzi scheme.

In short, the potential for failure or fraud is just incredibly high with these types of investments. If you do invest here, don’t do it with money you can’t afford to lose.

b. Company stock

Many investors, particularly those who worked many years for a single employer, approach retirement with a large position in company stock. For many of these investors, there is a large amount of loyalty and nostalgia felt for the company that employed them for so many years. In addition, many investors feel that because they worked “on the inside” for so long, they understand the company and feel that it is safe. It could never go out of business or even decline in value.

The list of companies that looked invincible but eventually faltered is a long one – companies like Kodak, Lehman Brothers, Enron, etc. Factors outside of the company’s control can lead to their demise – things like government regulation, environmental factors, changing consumer preferences, and new technologies.

Investing in the stock market is risky, even when done in a diversified portfolio. The S&P 500 lost more than 50% its value during the great recession. But investing in a single stock, you can lose 100% of the value of your investment.

If you have more than 10% of your retirement nest egg in a single company stock, you may want to consider how to start diversifying your position to reduce the risk to your retirement.

c. S&P 500

Moving from a single private investment or a single company stock to a more diversified portfolio is a great start toward reducing the risk in your portfolio. However, many investors make the mistake of focusing all of their nest egg in a portfolio of large, U.S. stocks. After all, an S&P 500 index fund is well-diversified, isn’t it?

Maybe. But you can likely do better.

Consider the decade from 2000 to 2009. This time period is what many refer to as “The Lost Decade”. If you had invested $1,000,000 in the S&P 500 on January 1, 2000, you would have been left with $910,000 at the end of 2009. In other words, over ten years you would have lost $90,000!

Even in a “diversified” portfolio you can suffer through long periods of sub-par returns. By investing in only one type of stock, like large U.S. companies, you are subject to specific risks that those companies face. During the “Lost Decade” the U.S. economy suffered through the tech bubble bursting, 9/11, the housing crisis and the Great Recession. Those events were most felt by large U.S. companies.

Meanwhile, other assets, like small company stocks, international stocks, and bonds, all posted positive returns over that period. They were impacted in different ways by the events described above.

In short, when looking to diversify your portfolio, typically the more the better.

3. Mismatch Between Goals and Investment Strategy

The third mistake I see people make has to do with the amount of risk they take in their portfolio. Often, there is a disconnect between investors’ goals and their investment strategy.

The biggest mistake of this kind is investing too conservatively. For example, it’s not uncommon for investors to come to me planning on selling everything in their portfolio when they retire and keeping it in cash or money market accounts. They assume that they have finished the growth or accumulation phase, so they should sell all of their growth assets and put their nest egg under the proverbial mattress.

This strategy only works if you have a very large portfolio and plan to take very little from it. It certainly won’t maximize your retirement income, or even keep up with inflation.

When designing your retirement portfolio, you want to make sure the investment allocation matches your retirement spending needs. The more you plan to spend, the higher the risk you will need to take in your portfolio.

4. Paying excessive fees

As you approach retirement, your nest egg has never been larger. This makes you a prime target for advisors who would like to charge you a percentage of your portfolio or sell you an annuity on commission.

While it makes sense to pay fees for services that add value, you should be sure you understand all of the fees you are paying and what you are receiving for those fees.

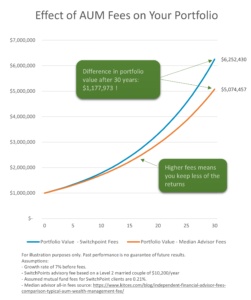

It’s not uncommon for investors to be paying 2% or more of their portfolio in fees (1% in mutual fund fees and 1% to the advisor). If you consider that the rule of thumb for a safe portfolio withdrawal rate is 4% in retirement, that means that half of the withdrawal is going to pay investment expenses.

Most advisors and mutual funds justify their high fees with lofty promises of market-beating results or their ability to protect you from losses. But the reality is that the vast majority fail to deliver on those promises. And selecting one of the few who will actually outperform the market in the future is a fool’s errand.

Instead, when looking for an advisor, find one that focuses on you and meeting your goals, rather than on pitching you a fancy product or strategy. Look for someone who focuses on the things within your control, like the things we’re talking about in this article – taxes, diversification, discipline, and planning.

Consider hiring someone who is compensated on an hourly or flat annual retainer, rather than commissions or a percent of your portfolio. You are likely to get more objective advice and save $1,000’a in fees.

For example, here’s the difference between our fees and the industry average over 30 years:

5. Letting Emotions Dictate Investment Decisions

Finally, don’t let emotions get in the way of your long-term plans. Selling during a downturn in the market can devastate your portfolio. Timing the market consistently is not a game worth playing. Even professionals don’t get it right.

Of course, the urge to do just that can be very strong, especially in an extended bear market. As humans we are wired for fight or flight. When we see our portfolios falling and falling, it’s only natural to want to get out – to flee to safety.

But unless you have a crystal ball, you’re likely to miss the recovery. Don’t turn your paper losses into real losses by selling at the bottom.

The market has always recovered after temporary setbacks. Did you know that even during the Great Recession of 2008, it took less than five years for the S&P 500 to regain it’s previous high? Five years may seem like an eternity, but anyone who doesn’t have more than a five-year time horizon probably shouldn’t be investing in stocks.

If you are nearing retirement, your time horizon is likely still at least 20-30 years. A temporary setback can only hurt you if you let your emotions get in the way.

To give yourself the best chance for success, make sure your portfolio is appropriate for your long-term goals and risk tolerance, and then stay disciplined even when the going gets tough.

5 Keys to a Successful Retirement

Let’s review these five principles, but with a more positive spin:

- Have a Plan

- Diversify Broadly

- Match Your Investment Strategy to Your Goals

- Only Pay for Services That Add Value

- Stay Disciplined

Following these five steps can help you avoid the common pitfalls I’ve seen time and again.

If you’re already guilty of one of these mistakes and aren’t sure how to turn things around or if you’d simply like an objective partner to help you maximize your retirement, lets chat.

You can schedule a complimentary, no-obligation introduction here.